NKT is launching its Green Finance Framework to further integrate the company’s sustainability strategy into its financing arrangements.

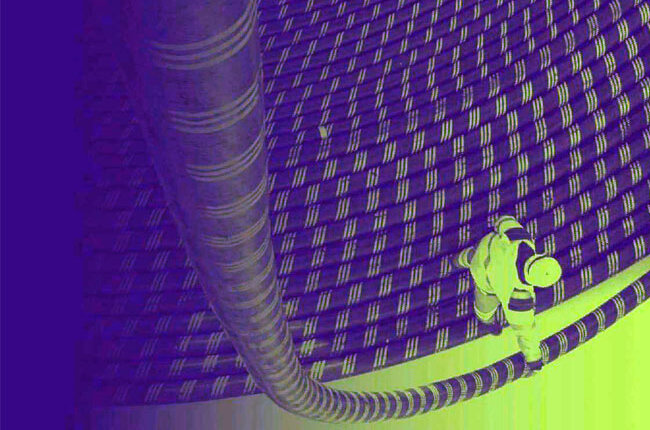

NKT is dedicated to connecting a greener world by enabling sustainable energy transmission through high-quality power cable technology. With the announcement of the Green Finance Framework, company is taking yet another important step on its sustainability journey.

“Sustainability is a key strategic priority for NKT. We enable the green transition of societies with our power cable solutions and have worked to reduce the carbon footprints of our cables e.g. by switching to green electricity in our production and recycling 100% of our scrap.

Having our sustainability strategy linked to our financing framework is yet another demonstration of our strong commitment to the fight against climate change,” says Company CFO, Line Andrea Fandrup.

The Green Finance Framework enables them to finance eligible assets and expenditures with distinct sustainable benefits. These may include, but will not be limited to, capital expenditures such as production machinery and equipment, technology and IT, buildings and R&D as well as operational expenditures such as staff cost, repairs and maintenance, energy and utilities, transportation and administration relating to the production of power cables used to connect renewable power generation to areas of consumption.

The Green Finance Framework has been developed together with Danske Bank, Nordea and Nykredit and is based on the 2021 versions of the International Capital Markets Association’s (ICMA) Green Bond Principles and Green Loan Principles, alongside the EU Taxonomy and the anticipated EU Green Bond Standard.

To confirm the transparency and robustness of the Green Finance Framework, NKT has engaged CICERO Shades of Green to act as an external reviewer, by way of a Second Party Opinion. CICERO Shades of Green has awarded Green Finance Framework a Medium Green shading with a governance score of Excellent.

The Green Finance Framework and CICERO Shades of Green’s Second Party Opinion are available on website at: https://investors.nkt.com/green-financing

About NKT

We connects a greener world with high-quality power cable technology and takes centre stage as the world moves towards green energy. Designs, manufactures and installs low, medium and high-voltage power cable solutions enabling sustainable energy transmission.

Since 1891, NKT has innovated the power cable technology building the infrastructure for the first light bulbs to the megawatts created by renewable energy today. NKT is head-quartered in Denmark and employs 3,900 people. NKT is listed on Nasdaq Copenhagen and realised a revenue of EUR 1.8 billion in 2021. NKT – We connect a greener world.

Construction of a green financial mechanism. The Guiding Opinions on Building a Green Financial System put forward the construction of a green financial development framework covering multi-sectoral and multi-cutting areas such as green credit, green bonds and green funds.

The Catalogue of Green Bond Support Projects (2021 Edition) clearly stipulates that high-carbon emission projects such as the clean use of fossil energy are no longer included in the scope of support; adopt the internationally accepted “no significant damage” principle, and green bonds are closer to the EU classification scheme and the global prevailing principle and establish a national unified carbon emission trading machine.

System, clarify the trading methods and settlement rules of the national carbon market; introduce carbon emission reduction support tools to reduce the capital cost of low-carbon projects such as clean energy.

Benchmark the international green financial standard system and improve the level of environmental information disclosure. First, revise green finance definition standards such as green credit and green industry catalogues in accordance with carbon neutrality goals, establish definition standards for green funds, green insurance, carbon pricing, etc., refine and list the technical indicators or thresholds corresponding to green finance standards or all economic activities in the catalogue as much as possible, and proactively consider integrating into the transformation.

Financial elements and biodiversity conservation needs. Second, further promote domestic financial institutions and enterprises to carry out environmental information disclosure, clarify the scope, content of disclosure, disclosure details, etc., issue information disclosure guidelines, and optimize the management of information disclosure of green financial products.

Third, deepen the use of financial science and technology innovation supervision tools, study and establish intelligent algorithm information disclosure, risk assessment and other rules and mechanisms, so as to effectively improve the unity, professionalism and penetration of supervision.